By U Pyae Phyo Aung (Ministry of Planning, Finance and Industry)

Six listed companies

On 28 February, 2020, Ever Flow River Group Public Co. Ltd, a logistics company, was given approval to join the listing on the Yangon Stock Exchange (YSX), thus increasing the total number of listed companies to six.

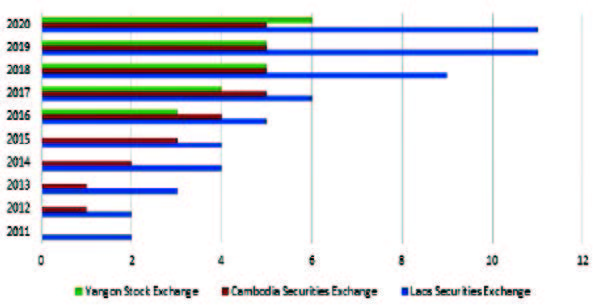

In comparison, the Ho Chi Minh City Stock Exchange was launched on 20 July 2000 and currently has 377 listed companies. Meanwhile, the Hanoi Stock Exchange has 367 listed companies after beginning to operate on 8 March 2005. Meanwhile, Laos has 11 listed companies on the Lao Securities Exchange (LSX) after opening on 10 October 2010 and Cambodia has 5 listed companies since launching its Cambodia Securities Exchange on 18 April, 2012.

Comparison of stock exchanges of Laos and Cambodia

Number of listed companies across CLMVT nations (28-2- 2020)

The Yangon Stock Exchange (YSX) was launched on 9 December 2015 and has been 4 years since it began selling shares. We are only in the beginning of 2020 now and there are many options for increasing the number of listed companies on YSX.

It’s easier said than done for a public company to be listed on the stock exchange, according to experiences in assessing listing applicants. Then there are rules and regulations to follow after being approved to join the listing.

This systematic organization of rules and regulations serves to increase the amount of trust placed by citizens looking to invest and investing individuals and organizations on a listed company. They are also prioritized to minimize significant losses, in comparison to the situation faced by some public companies presently. The corporate value of listed companies rise as well.

Different natures of YSX listed companies

All the listed companies on the Yangon Stock Exchange had to satisfy the listing criteria of YSX. People looking to invest on the stock exchange should research the different sectors that the listed companies each work in, as well as their future pros pects, working nature, the experience of their administrators, transparency of financial statements, and any news related to them. In addition, you must also clearly know if you want to be an investor or a trader. This will help you make smart decisions and mitigate risks.

Upon close inspection, it becomes clear that the listed companies on YSX are from different business industries. While there isn’t a wide variety of industries to choose from, the addition of a new listed company is a new investment opportunity for citizens looking to invest and one more variety of industry to choose from as well. New investors will appear as well.

Table (1) shows the business industry of YSX listed companies and their opportunities for success

Myanmar’s stock exchange is just beginning to develop and has many opportunities to learn from the experiences of neighboring countries. They can also meet and have honest and transparent discussions with people in the market. All it needs is some time and infrastructure to become successful.

Myanmar’s investing scene is a new market. The six listed companies on YSX are peculiar. They are all established in line with the Myanmar Company Act and are of different business industries. This provides a lot of choice for investors looking to invest and could be one of the attractive points for the market to succeed.

The second noteworthy point is that, according to DICA, there are over 60,000 registered companies in Myanmar but only 260 are public companies. Many companies are preparing to enter the stock exchange listing and will enter the public investment sector too. This is why share issuance will ensure equity fencing is practiced expansively in a legal setting and can be developed quickly in a short amount of time.

The third thing are the criteria themselves. If you compare them with the criteria of other stock exchanges, you will find many differences. There are 17 criteria for YSX, including minimum number of investors, market capitalization and profit prospective. Careful scrutiny will show YSX’s differences with other stock exchanges. This is a good opportunity for newly entering companies.

Table (2) shows comparison of listing criteria between YSX and stock exchange of other nations

Foreign ownership in a Myanmar company is permitted at 35 per cent by the Myanmar Company Act (2017). The investment and share market can grow exponentially in a short time if that fact is utilized effectively.

The Securities and Exchange Commission of Myanmar (SECM) loosened restrictions on brokerage business fees in 2018 and 2019 and permitted online trading in December 2017. Trading on the YSX noticeably increased on 2019.

Table (3) shows annual sales of stock

Note – includes block trading

The addition of a new listed company is great news for the stock market and an additional investment opportunity for citizens willing to invest. The board of directors of the six listed companies deciding to enter the Yangon Stock Exchange have to be commended as well.

YSX was able to surpass the Cambodian stock exchange with minimal errors in four years. The efforts of SECM, YSX, Securities Companies, and Japan Exchange Group (JPX) and the advisors from there are invaluable.

We must continue to work hard and reach an equal footing with the stock exchanges of Viet Nam and Thailand, while growing our strengths and resolving our disadvantages.

(Translated by Pen Dali)