By Suzuka YOSHIDA

LAST time I wrote about the rise of the Global South. However, winners and losers are starting to appear in the global South on the financial side.

The current international monetary system began with the Bretton Woods system after World War II. After the Nixon shock and the Asian currency crisis, many countries are now shifting to a floating exchange rate system. Because trade and investment transcend national borders, any country is susceptible to the effects of international economic turbulence and is sensitive to the international situation that is generating those turbulences.

Needless to say, Russia’s invasion of Ukraine has caused the biggest change in world affairs from last year to this year. No exact outcome of the war can’t be seen yet, but it has triggered new changes in the world of finance.

Financial sanctions by the United States and its allies have begun to bring about major changes in the financial world. Far from being a change, there is a possibility that it will be a big change, such as a crustal movement, or even “the birth of a new stellar group.”

This time, I will look at changes in the global South on the financial front.

In the wake of financial sanctions imposed on Russia

For several decades, governments and private companies around the world have used the US dollar as a key currency and other SDR currencies such as the euro, yen, British pound, and Chinese yuan in their economic activities. It was thought that this system would continue into the future, but recently, there has been a sudden activity increasing, such as the creation of a new trade settlement system among middle-developed countries.

Their activity was triggered by Russia’s invasion of Ukraine. After the outbreak of war in February 2022, the United States and its allies restricted access to dollar settlements and foreign exchange reserves to keep Russia out of the dollar trading network. It started with the idea that financial sanctions would be an effective way to force Russia out of Ukraine, as Russia would then be forced to pay interest on dollar-denominated bonds using their limited dollar. However, contrary to the intentions of the United States, although the ruble fell sharply at one point, it generally recovered in two to three months.

Meanwhile, market prices of Russia’s export commodities, oil and gas, have soared, and grain prices have begun to soar. Countries in the Global South have run out of foreign exchange reserves. In the United States, the consumer price index has become overwhelming.

Countries in the global South have suffered varying degrees of damage. Some countries have been hit even harder by the sharp drop in tourism due to COVID-19. What they have in common is that the dollar shortage has progressed sharply, and leaders of affected countries have started to think that it would be better to create a world where the dollar is no longer used.

To put it simply, the world economy fell into the following trend;

High oil prices, high grain prices ⇒ High prices around the world ⇒Inflation accelerated in the US, and US policy interest rates rose ⇒ Global South currencies will depreciate further ⇒ Inflation in the countries of the global South will accelerate further ⇒ Extremely short of the dollar ⇒ Some countries have begun to move away from the dollar.

This negative chain continues.

Create ties between currencies other than the dollar

The only thing the countries of the global South have found out of the shortage of dollars is to create another world which is a dollar-less world. They implemented financial measures such as swapping currencies with other countries and changing the settlement currency to a currency other than the dollar. This is because it is the least risky way to reduce transaction costs.

The United States and its allies intended to use the strength of the US dollar to harass Russia with financial nets, but instead turned the dollar away from the global South.

What will happen next?

Confidence in the dollar remains strong, but its demand is likely to decline. Then, under the system of one country-one currency, many thin threads will appear that connect the currencies of each country. It will be like a dim nebula floating in the darkness far away from the dollar. That said, it’s still in the early stages of exploration.

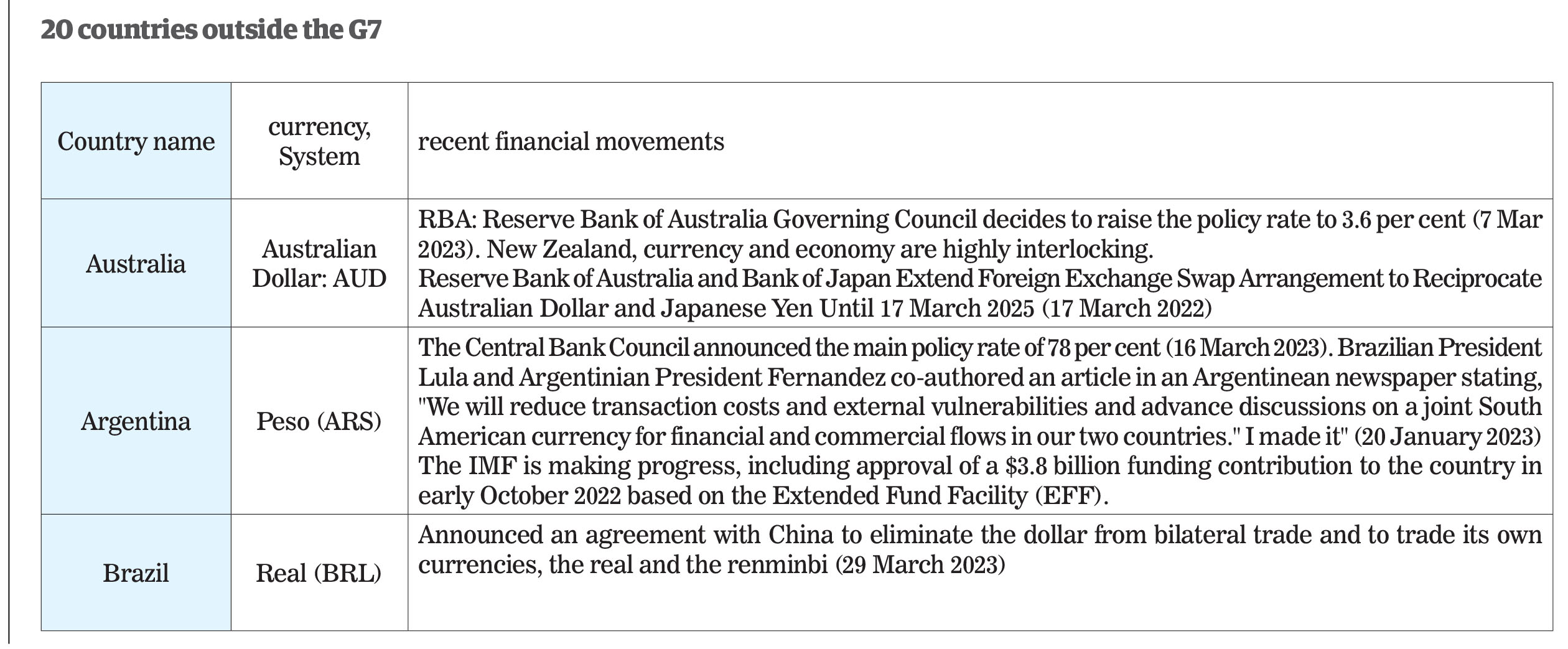

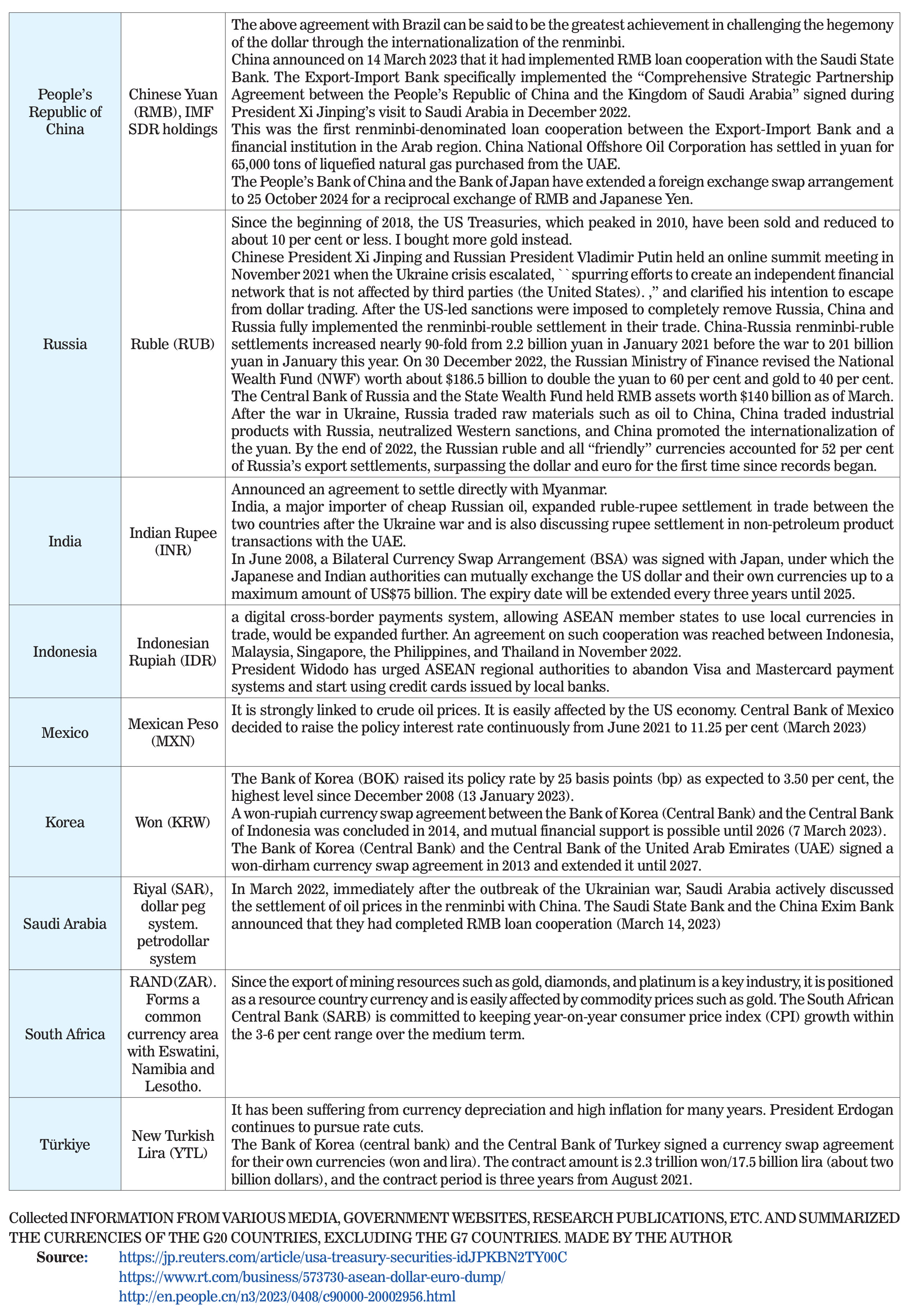

Changes are beginning to appear in the G20, which is a cluster of middle-income countries in the Global South. I have summarized the changes in the G20 countries, excluding the G7 countries, in a table. Please take a look.

If nations of the world agree to share a system of payment in digital currencies in the future, then the outnumbered Global South will be able to negotiate on an equal footing with the dollar. Until then, it will continue to be a winner or loser in the global South on the fringes of this dollar-centred system. Similar to the great migration of birds and animals just before a cataclysm, the depreciation of the dollar is just around the corner.

What we are seeing now is the germination of a new financial system.