During the 4th year period, the Central Bank of Myanmar has carried out reform activities, and that an interview was conducted on Governor U Kyaw Kyaw Maung for the esteemed readers.

Question: Kindly explain us over the reduced bank interest rate by the Central Bank of Myanmar.

Answer: We made the announcement after the World Health Organization defined the COVID-19 outbreak as a pandemic on 12 March 2020 to counter the negative impact and ease the state economy with the intent to help assist the economy. According to our directive, beginning 12 March 2020 the interest rate of Central Bank has been changed from (10) per cent to (9 point 5 per cent) by reducing down (0 point 5) per cent.

The minimum bank deposit rate will be lowered to (7.5) percent from (8) per cent while the maximum lending rate will be lowered to (12 point 5) per cent for collateralized loans. It is to fix (15 point 5) per cent for non-collateralized loans. These changes are to take effect on 16 March 2020. For immediate support to stimulate the state economy, Myanmar Central Bank interest rate has been pulled down from (9 point 5) per cent to (8 point 5) per cent additional cut of (1) per cent.

With the interest rate reduced, the minimum bank deposit rate and the maximum lending rate would be reduced to (1) percent compared to earlier bank rate. In other words, the minimum bank deposit rate would be (6 point 5), and that the maximum lending rate would be (11 point 5) per cent.

The maximum lending rate would not be more than (14 point 5) per cent either collateralized or non-collateralized. The changes take effect on 1 April 2020. The reduced bank interest rate is tantamount to easing “borrowing cost” and elevates the investment by pumping goods and services in the market, resulting with strong “economic activities.

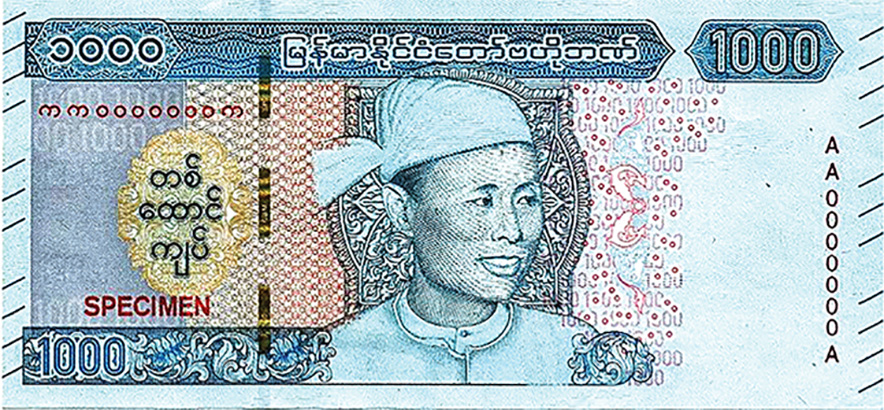

Q: Kindly tell us about new bill of 1000-kyat note with Bogyoke Aung San portrait.

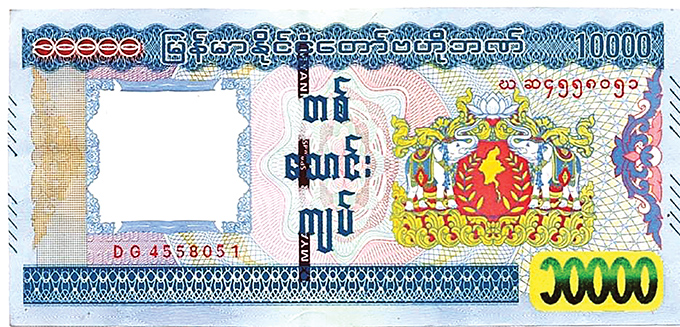

A: We have planned to print new bill with Bogyoke Aung San portrait since a long time. The Central Bank of Myanmar introduced a 1,000-kyat note on 4 January 2020, the independence day of Myanmar, honoring Bogyoke Aung San. After that, we have plan to print bills denominating MMK 50; MMK 100; MMK 5,000; and MMK 10,000.

Q: Please tell us on the work programme in stabilizing foreign exchange rate.

A: In short term measure we are trying to keep preventive step against rapid and sharp foreign exchange rate fluctuations. With the intent to fill up the foreign reserved fund of the nation, two types of foreign currency auctions are carried out. The main foreign exchange policy instrument of the many banks is foreign exchange auctions through which the central bank purchases or sells foreign exchange to commercial banks. The aim is to stabilize the exchange rate.

During a short term period, with intent to prevent the sharp and acute foreign exchange rate fluctuations, the deed of “Intervention Auction” is being exercised in selling as well as in buying.

In replenishing the state owned foreign reserved funds, “Accumulation Auction” such as that of single buying method is being practiced. [In plain words, an auction is usually a process of buying and selling goods or services by offering them up for bid, taking bids, and then selling the item to the highest bidder.]

The Central Bank of Myanmar is carrying out in its daily routine deeds such as that of the “Intervention Auction” and “Accumulation Auction” in accordance with the stipulated rules and regulations. The sole aim and objective of Myanmar Central Bank is to reduce the deep and rapid fluctuations of foreign exchange rate in the country, easing the cash flow in the foreign currency market. It is not with the intention to put a certain foreign exchange rate in terms of pegging or benchmark.

Q: Please explain the development of banking sector.

A: The stability of fiscal system is vital for the economic development of a nation. The Central Bank is regularly issuing rules and regulations in conjunction with the necessary directives in strengthening the banking sector, in accordance with the 2016 Financial Regulations for improving financial inclusion.

Supervision and scrutiny is being systematically carried out whether on the part of the banks abide by the existing laws, rules and regulations, and directives.

In offering better banking services to the general public, the private banks have been permitted to operate, and that(27) private banks and (2,000) branches are now functioning.

When it is not possible in establishing a bank branch or banking office, their representatives are allowed to perform banking services through Mobile Banking system. [Mobile banking refers to the use of a Smartphone or other cellular device to perform online banking tasks while away from your home computer, such as monitoring account balances, transferring funds between accounts, bill payment and locating an ATM.] So far (12) private banks have been permitted to do Mobile Banking business.

For the advantage and benefit of the people residing in remote areas, where regular banking service is not accessible, permission has been given to (4) Mobile Network Operators and (1) Non-Bank Financial Institution – – NBFI.

In facilitating the business people who need to get loans, the Central Bank has allowed the operation of Non-Bank Financial Institutions that caters “Financial Inclusion”. So far (29) NBFIs have been established.

As the import and export is surging in the country being undertaken by Myanmar citizens, the situation calls to ease foreign banking process. Therefore, (13) foreign banks and its branches are now functioning.

On the third opportune time, the selection of foreign banks is in process. It has been considering in providing permission to foreign banks and their branches along with their subsidiaries. Moreover, the local banks will have the opportunity to engage in foreign banking business for “Equity Participation” for those who intend to share more than (35) per cent investment contribution. The approval would be considered case by case.

Q: Please express on the aspect of supervision and scrutiny for the stability of financial sector.

A: After giving approval to monetary organizations to do banking business in the country, the necessary inspection and scrutiny are being carried out, whether they complied the rules and regulations or otherwise. Under the watchful eyes, the task is done through “Risk-Based Supervision”. [Risk-Based Supervision (RBS) is gradually becoming the dominant approach to regulatory supervision of financial institutions around the world. It is a comprehensive, formally structured system that assesses risks within the financial system, giving priority to the resolution of those risks.]

Keeping the banks to be financially strong, the Central Bank closely watched whether the prescribed ratios are actually maintained or not.

With a view to prevent the bank from collapsing, the likelihood of risk is being classified with the status of high, medium and low. Step by step scrutiny has been carried out and necessary inspection tasks have been assigned over the management. Timeline has been dotted to remedy and to fix the drawbacks and faults.

The Banks, the financial companies, and the Mobile Bankings are being hooked up with the external auditing teams to upkeep the necessary data.

Q: Tell us about anti-money laundering.

A: Anti-Money Laundering/Combating the Financing of Terrorism is termed as (AML/CFT). Money laundering and the financing of terrorism are financial crimes with economic effects. Whether the banks follow the rules and regulation have been checked in accordance with the international standards and norms. AML/CFT controls, when effectively implemented, mitigate the adverse effects of criminal economic activity and promote integrity and stability in financial markets. The main checklist to apply has (12) basic criteria as follows.

(1) Governance; (2) Customer Due Diligence; (3)Transactions and Account Monitoring; (4) Risk Assessment System and Procedures for Customers and Products/Services; (5) STR Reporting; (6) Threshold Transaction Reporting; (7) Politically Exposed Persons (PEPs); (8) Correspondent Banking; (9) Wire Transfers; (10) Record Keeping; (11) Internal Controls; and (12) Staff Training

The banks are being categorized into the large; the medium; and the small for inspection purpose. A total of five large banks have been inspected. A total of six medium banks have been verified in February 2020. The small banks would be inspected soon.

In making the banks strong and credible, they must be inconformity with the international norm and system. In preventing the illegal money from entering the fiscal main stream and system, the “source of funds” is to be mainly scrutinized.

With regards to the AML / CFT matters, Myanmar has already undergone the scrutiny through the “Mutual Evaluation” pattern among the nations in 2007 – 2008 financial year; and again in 2017 – 2018 financial year. Myanmar received (40) suggestions and recommendations which have been taken action and responded through “Mutual Evaluation”. In August 2019, the Asia Pacific Group on Money Laundering – – APG has issued (99) points suggestions and work programme that Myanmar needed to follow and comply.

At the APG meeting held in Beijing of PRC in January 2020, Myanmar responded with the progress report with regards to (99) points, thereby, only (14) points remain to be cleared by Myanmar. Again in February 2020, Myanmar explained the progress report at Paris Meeting in France, and only (8) points remained to be cleared.

Among the (8) points to be taken up, the Central Bank of Myanmar has to shoulder (2) topics. The first priority of the Central Bank is to carry out such as that in scrutinizing more seriously over the current contact person; such as that of paying more attention over the most influential figures; such as that of high risk prone areas; such as that of suspected transfer along with the tip-off; such as that of high risk loss at some areas. The matters are to be taken up with “on-site examination” being evaluated in 2019 December for AML / CFT risk assessment. The medium size banks are to be evaluated for the final round during September 2020.

The second topic is that the official issuances of work licence for actual demonstration with regards to the implementation over the rules that was permitted to do business in foreign cash transfer performances. Moreover, these rules and regulations are to be spread out and also to supervise the processes. The tasks are to be completed in January 2021.

The Financial Action Task Force (FATF) is an inter-governmental policymaking body whose purpose is to establish international standards, and to develop and promote policies, both at national and international levels, to combat money laundering and the financing of terrorism. The FATF is monitoring the work carried out by Myanmar, and reported the progress to the Asia Pacific Joint Group – – APJG, once every four months.

Q: Kindly explain the development plans being carried out for the accounts clearances system with regard to cash settlements.

A: Draft bill in legal aspect with regard to payment and settlement systems is in the process with the assistance of the experts from the World Bank. The Central Bank Network System (CBM – – Net System) gradually upgrading for wider use. QR code payment is a contactless payment method where payment is performed by scanning a QR code from a mobile app. This is an alternative to doing electronic funds transfer at point of sale using a payment terminal. Work is underway to implement National Standard for QR Code – – MMQR in Myanmar.

The Central Bank of Myanmar (CBM) issued a directive on merchant acquiring services (notification 7/2020) on 13 March 2020.

Merchant acquiring is an integral part of card payment transactions processing. International Cards such as the Master Card; the VISA Card; the JCB; and the UPI are already in the market. The Alipay and the WeChat Pay being introduced by e-wallet provider are also functioning. With regards to their Merchant Acquiring Services, it is to be regulated for smoother functioning.

In connection with the Automatic Teller Machine – – ATM; it is vital and necessary to seek prior official approval from the Central Bank before installing Cash Recycling ATM/ Cash Recycler Machine – CRM. Necessary directive has been issued to the relevant banks on 24 March 2020.

For the ease and comfort of the bank clients, they are suggested to obtain the facilities such as that of mobile banking services; such as that of ATM; such as that of Cash Recycling ATM/Cash Recycler Machine – CRM; instead of taking the burden by appearing in person at the bank counters. All the banks have been advised and directed to upkeep the ATM with adequate supply of cash for the customers and clients, and maintain the ATM in proper functioning order.

Q: Please add message from the Central Bank to the people.

A: I would like to share some information with all seriousness to the people. Nowadays, the cybercrime is on the rise such as that of using the Telecommunication Network for misuse and embezzlement; that of financial misappropriation; that of accepting cash deposits and savings without authorization.

For example, some people started to contact innocent people through the online communication, and then varieties of ways are employed to deceive and exhort money from the victims; some cybercrime includes by offering enormous amount of interest rate, and asked the victim to deposit cash online; some wrong doers use Facebook Account in soliciting communal fund as main host with the fake promise to make income generation, eventually, absconding with the accumulated communal funds.

I would like to conclude that with the backdrops of cheating, deception and fraudulent, the people are advised and urged to study the information and communications technology, and to apply for beneficial results. On the other hand, the responsible persons in this domain must effectively contain, control and restrain the Cybercrime in the financial realm.

By Shin Minn

Photo Kay Kay

Translated by UMT (Ahlon)